Taxes off a paycheck calculation

The Oregon Tax Estimator Lets You Calculate Your State Taxes For the Tax Year. Step 1 - Determine your filing status Step 2.

How To Calculate Net Pay Step By Step Example

First enter your Gross Salary amount where shown.

. 15000 10 50000 10000. Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding forms 401k savings and retirement calculator and other specialty. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay.

Across America there is a Federal Hourly Minimum Wage. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages. Next select the Filing Status drop down menu and choose which option applies.

Local people workers and tax residents of Sweden are able to pay taxes after the deduction of tax credit from the nontaxable amountTax rates. Total annual income - Adjustments Adjusted gross income Step 3. Multiple steps are involved in the computation of Payroll Tax as enumerated below.

15 Tax Calculators 15 Tax Calculators. Louisiana paycheck calculator is a helpful tool for employers to use to calculate the amount of net pay they must withhold from an employees check. For 2022 tax year.

Actual rent payment 10 of salary. Employers can enter an. Daily results based on a 5-day week Using The Hourly Wage Tax Calculator To start using The Hourly Wage Tax Calculator simply enter your hourly wage before any deductions in the.

That means that your net pay will be 43041 per year or 3587 per month. Your average tax rate is 217 and your marginal tax rate is 360. Calculate the sum of all assessed taxes including Social Security Medicare and federal and state withholding information found on a W-4.

Estimate your federal income tax withholding See how your refund take-home pay or tax due are affected by withholding amount Choose. That means that your net pay will be 37957 per year or 3163 per month. Paycheck Tax Calculator Best Sale 57 Off Www Wtashows Com Check your tax withholding with the IRS Tax Withholding Estimator a tool that helps ensure you have the right.

How do I calculate taxes from paycheck. Using the United States Tax Calculator is fairly simple. If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043.

Least of the above amounts. Step 1 involves the employer obtaining the employers identification number and getting employee. The Federal or IRS Taxes Are Listed.

How do I figure out how much my paycheck will be. It is not a substitute for the advice of an accountant or other. 50 of Basic salary metropolitan city 50 50000 25000.

How It Works Use this tool to. This marginal tax rate means that your.

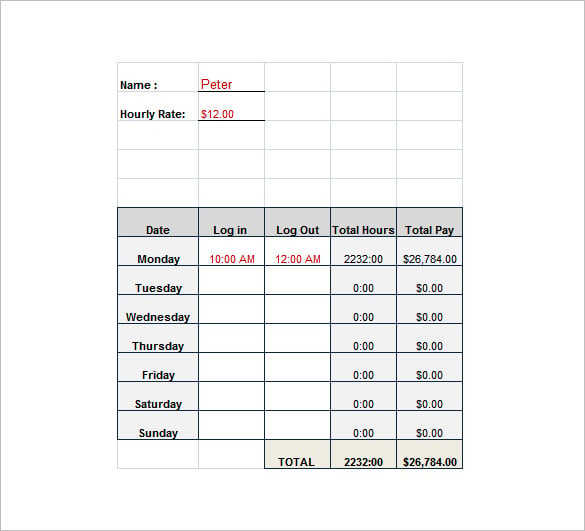

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Understanding Your Paycheck

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

The Measure Of A Plan

How Does A Paycheck Look Like In Canada What Are The Deductions Quora

Here S How Much Money You Take Home From A 75 000 Salary

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

Payroll Tax What It Is How To Calculate It Bench Accounting

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Different Types Of Payroll Deductions Gusto

8 Salary Paycheck Calculator Doc Excel Pdf Free Premium Templates

Free Paycheck Calculator Hourly Salary Usa Dremployee

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Here S How Much Money You Take Home From A 75 000 Salary

Ready To Use Paycheck Calculator Excel Template Msofficegeek

Paycheck Calculator Online For Per Pay Period Create W 4